Roth ira contribution calculator 2020

Roth IRA Contribution Limits for 2021 and 2022. The historical Roth IRA contribution limits have steady increased since the Roth IRA was first introduced in 1997.

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

2020 generally require.

. In 2022 individuals who qualify to make a maximum contribution to a Roth IRA can contribute up to 6000 or 7000 if they are over age 50. The contribution begins phasing out at 129000 for single filers and. You cant make a Roth IRA contribution if your modified AGI is 140000 or more.

Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account. Your filing status is single head of household or married filing separately and you didnt live with your spouse at any time in 2021 and your modified AGI is at least 125000. A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning.

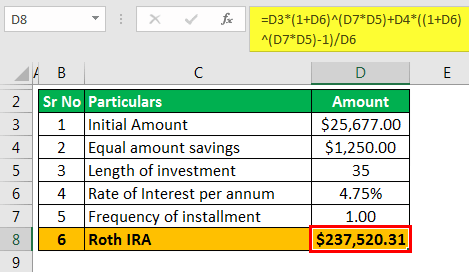

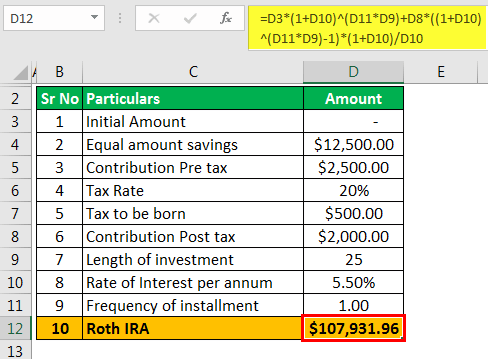

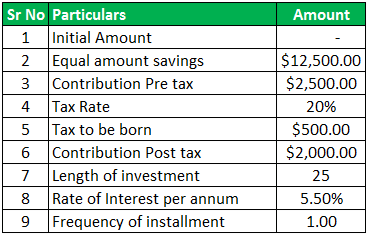

IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you. Roth IRAs have the same annual contribution limits as traditional IRAs for 2021 and 2022. Step 7 Use the formula discussed above to calculate the maturity amount of the 401k.

If youre under age 59½ and you have one Roth IRA that holds proceeds from multiple conversions youre required to keep track of the 5-year holding period for each conversion separately. Youll still have a 45000 taxable distribution from the conversion even though the Roth account is now worth only 35000. Learn how they are determined and how you can fund these accounts.

You cant make a Roth IRA contribution if your modified AGI is 208000 or more. Step 5 Determine whether the contributions are made at the start or the end of the period. Rolled over a Roth 401k or Roth 403b to the Roth IRA.

You must have earned income to qualify to contribute to a Roth IRA. In 2021 the Roth IRA contribution limit remains at 6000 with a 1000 catch-up contribution if you are 50 or over. The Roth IRA has contribution limits which are 6000 for 2022.

Fortunately you can avoid this unfavorable outcome by reversing the Roth account back to traditional IRA status. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. From IRS Publication.

Converted a traditional IRA to the Roth IRA. The lower of 6000 or your taxable compensation. Converting to a Roth IRA may ultimately help you save money on income taxes.

If you withdraw less than the RMD amount you may owe a 50 penalty tax on the difference. The money then compounds tax-free. Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts.

For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Act in March 2020 allowed for the withdrawal of up to 100000 from Roth or traditional IRAs without having to pay the 10. The Roth IRA is attractive for lower-income earners because you get to contribute lower-tax or no-tax money.

Earned income can include taxable alimony or other spousal maintenance nontaxable combat pay and some taxable non-tuition. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. Heres the lowdown on Roth IRA rules including contribution limits eligibility rules income phase-outs and withdrawal limits.

Use a Roth conversion to turn your IRA savings into tax-free RMD-free withdrawals in retirement. A Roth IRA is one of the best accounts for growing tax-free retirement savings and it takes just 15 minutes to open one. Starting at age 72 age 70½ if you attained age 70½ before 2020.

The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. First place your contribution in a traditional IRAwhich has no income limits. Rather a backdoor Roth IRA is a strategy that helps you save retirement funds in a Roth IRA even though your annual income would otherwise disqualify you from accessing this type of individual.

This included the first RMD which individuals may have delayed from 2019 until April 1 2020. View the current and historical traditional and Roth IRA contribution limits since 2002. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship. Going back to our example lets say the value of the Roth IRA drops from the initial 50000 to 35000. First contributed directly to the Roth IRA.

Roth Ira Calculator Calculate Tax Free Amount At Retirement

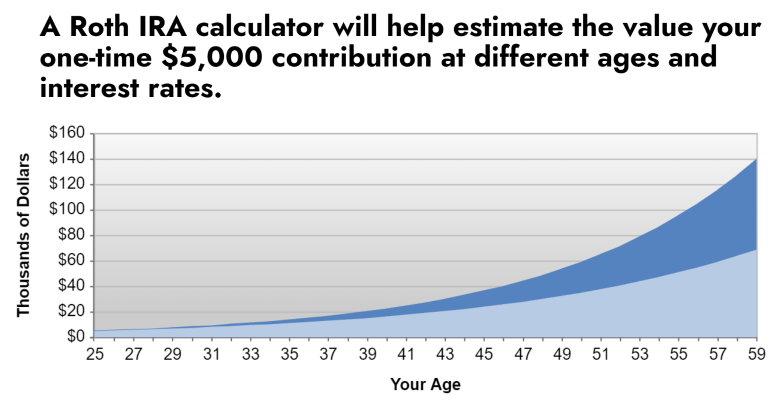

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Why Most Pharmacists Should Do A Backdoor Roth Ira

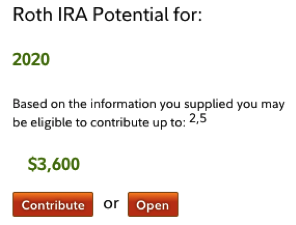

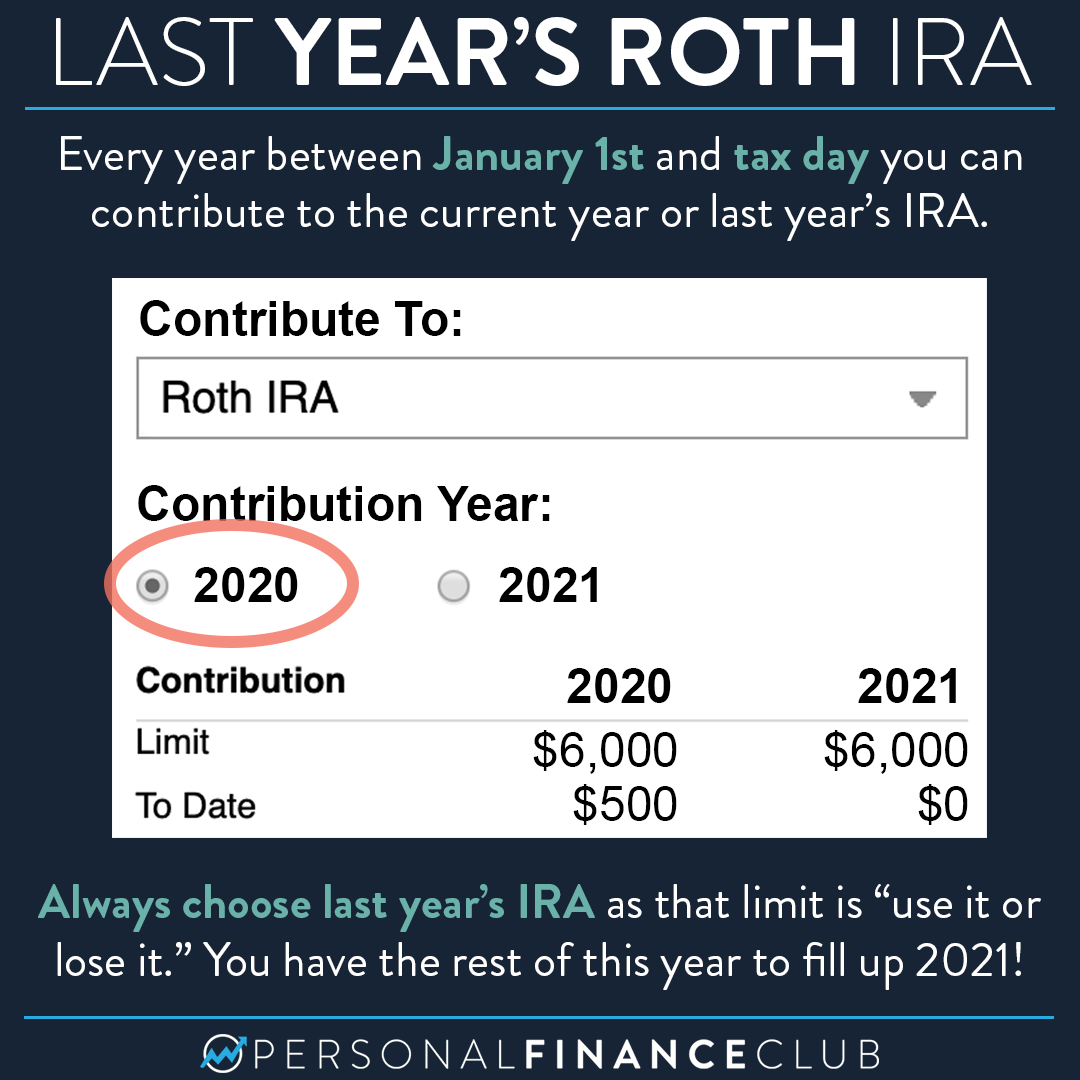

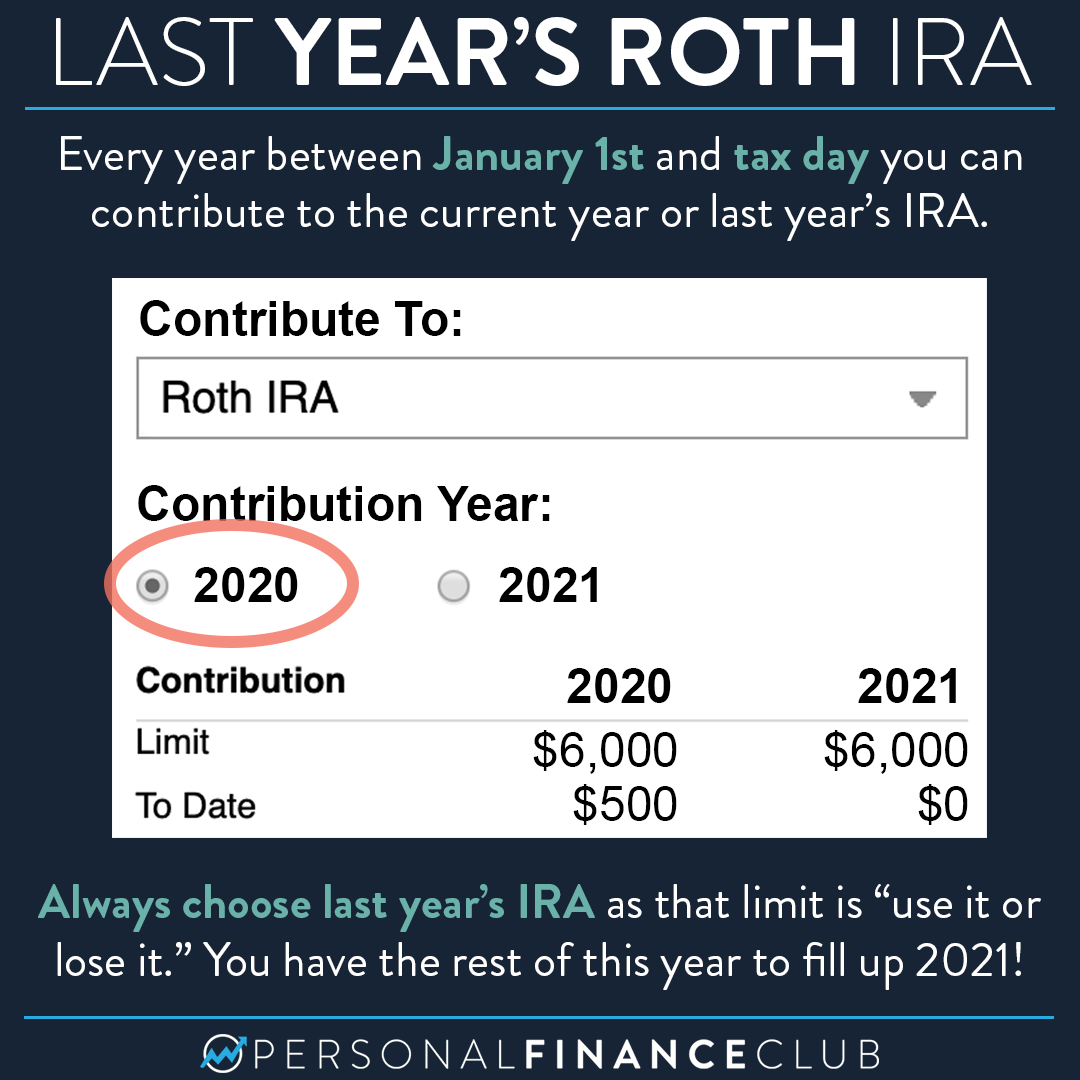

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

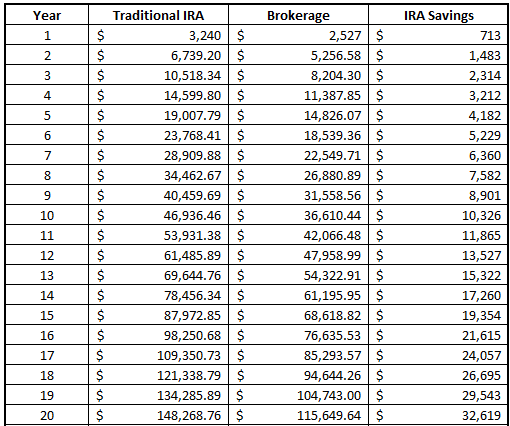

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

Historical Roth Ira Contribution Limits Since The Beginning

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Historical Roth Ira Contribution Limits Since The Beginning

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira For Millennials And Gen Z Wouch Maloney Cpas Business Advisors

Roth Ira Calculator Calculate Tax Free Amount At Retirement

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified